Cohousing Costs After You Move In: Part II Findings of the Study

Part I of this series described how Coho/US and CRN have co-ventured research into the annual budgets of cohousing communities; obtained the annual budgets of 20 communities comprising 611 units; and analyzed these budget materials to help develop some consistent interpretations of community budgeting practices. In this Part II, we present some of the actual numbers.

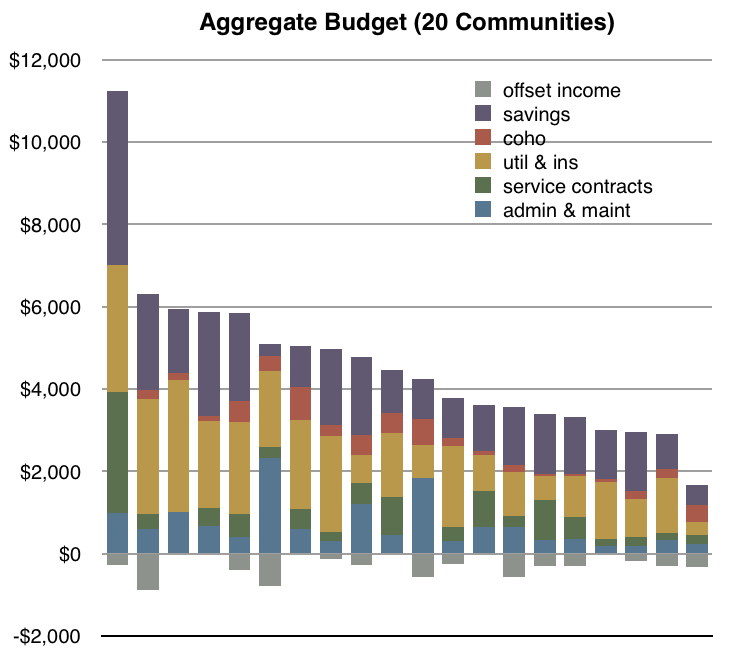

The budget analysis following emphasizes the revenue side of the annual budget: That is, the “tax” that community members agree to impose upon themselves in the form of annual condominium dues, home owner association fees, assessments (special or otherwise) — all of which we will now refer to as the “dues”. What’s actually spent in a given year may vary, sometimes a lot, from what’s collected. But in terms of revenue collected in anticipation of specific purposes, we’ve sorted it out like this:

1. Self-performed Administration & Maintenance (on average, 15% of budget). Investments of volunteer hours can be very high, but the actual cash costs of self-performed property management activities can be pretty low. These annual costs include basic tools, materials and supplies for activities such as routine repairs and replacements (e.g., tableware), cleaning, gardening and landscaping. Annual administrative costs are things like office supplies, an occasional computer upgrade, or an online subscription service like Quickbooks. Also included here are episodic service calls: Something is leaking? Call the roofer, call the plumber (if you can’t fix it with your own skills and tools). We class these calls as “self-performed” because nothing happens if the community does not initiate it on an as-needed basis. Range of annual dues across all 20 responding communities: $50 to $2,890 for the “average” unit of the community.

In contrast to “self-performed” activities, there are …

2. Annual Trade and Professional Contracts (12%). Many communities need, or want, to pay for services they can’t, or choose not to, do for themselves. Routine “tune-up” contracts for common HVAC are typical. Tall buildings are likely to have elevator inspections, window-washing, and/or life safety monitoring on an annual basis. A minority of communities will hire “outside” companies to clean the commons or gutters, plow snow, perform regular groundskeeping — or, hire a professional bookkeeper to process revenue and expense transactions. Rare but not unheard of, a cohousing community may hire a professional property management company to oversee all the other contracts and some of the maintenance. Range of dues: $80 to $2,950.

3. Utilities and Insurance (34%). Typical cohousing utilities are electricity, water/sewer, and gas or fuel oil on community owned-and-paid meters. A minority of communities have shared internet — although very few identify “telephone” as a needed community utility. A few communities sustain the “atypical” costs of water wells, septic fields, or wood chips for multi-fuel power plants. Insurance costs are mostly for property damage, but may also include coverage for directors’ liability and similar risks. Range of dues: $310 to $2,794.

4. Savings (33%). Savings are funds collected this year, to be spent at a future time. The great majority of savings goes into a long-term capital replacement reserve fund — e.g., money getting saved up for the roof replacement in 2025. A small portion (±2%) is sometimes set aside in a contingency fund, to pay for unexpected ugly surprises — e.g., the hot water heater ruptures five years before it’s supposed to. But not all communities have a separate contingency plan, and instead rely on the reserve fund to cover emergencies. Range of dues: $320 to $4,740.

5. Cohousing (6%). This category seeks to identify and accommodate costs that are somewhat unique to the cohousing lifestyle: Child care, consensus training, retreats and celebrations, donations to Coho/US, replacement of dining room furniture or a new hot tub installation — it’s a long and idiosyncratic list of possibilities. While these costs are only a small portion of the annual community budget, they are nonetheless often a source of energetic budget debate. Range of dues: $130 to $1,240.

6. Offset Income (negative 6% … about the same value as “cohousing” costs). Most revenue of the annual budget comes from the condo dues … but not quite all. A majority of communities have some sort of non-dues revenue that helps to pay the annual expenses. Typical revenue sources include leasing of “excess” land or parking, or occasional renting out of the commons; on-site businesses like a small store or office building; guest room fees; and net revenue from solar panels. Also included in this category is “roll-over” money = funds collected in the previous year, but unspent, and therefore available to write down this year’s anticipated expenses. Range of negative dues: $0 to $860.

Summary. Obviously, there is enormous variation of dues from one community to the next, and it’s dangerous to speak of an “average” or “typical” cohousing community. Where does this variance come from? Regional cost differences, urban versus rural, and simplicity (or complexity) of design and construction, all have roles to play … but, we think these are minor roles. In our view, the two major differences that best explain this range of budgeting are:

1. How much is owned in common? Some cohousing communities hew close to the suburban HOA model, and feature single family or duplex homes on separate deeded lots (land parcels). Co-ownership is limited to the common house, and some perhaps-not-expensive common yards and parking. In such cases, the amount of real estate that needs to maintained from the common budget, or heated from the common meter, or insured under the common policy, is not very much. In contrast, condo-style cohousing in mid-rise “apartment” construction may co-own the entire building envelope (exterior); a corridor network with stairs and elevator; the HVAC plant and all utilities; plus a below-grade parking garage. All of which is relatively expensive to operate, maintain, and insure.

2. How much is hired out? There’s a big hours and dollar budget difference between do-it-yourself, versus hiring others to do it. Some communities are proud of how much they can do with their own time and hands; others may feel like they lack the appropriate construction skills, or that they’d rather spend scarce time on activities more rewarding than routine maintenance. But it’s no secret to anyone that hiring others to do things for you conserves valuable time at the price of valuable cash. (One odd feature of this entire study, and cohousing budgeting in general, is that it tracks cash closely, but rarely provides or analyzes any data about the time-money trade-off.)

Bottom line: Look at the “Aggregate Budget” chart, which lines up our 20 responding communities from highest to lowest annual dues per unit. At the two extremes, we have high dues of about $11,000, and low dues of about $1,500. It’s safe to infer that the high end involves both much owned in common and much hired out to professionals — while the low end is a community with far less owned in common, and a powerful DIY commitment. But the distribution also shows a strong and well-defined “middle ground”, where the median quintile for annual dues per unit is about $3,800 to $5,000. If your community is near these numbers, calling your dues “typical” is not unfair.

Philip Dowds, an off-the-clock architect, is a ten year resident of Cornerstone Cohousing, and current Board Treasurer of Coho/US. Part II to come: Is cohousing cheaper, really?

Category: HOA Fees

Tags: budget, Finance

Views: 2083