Cohousing Costs Exactly the Same as “Regular” Housing

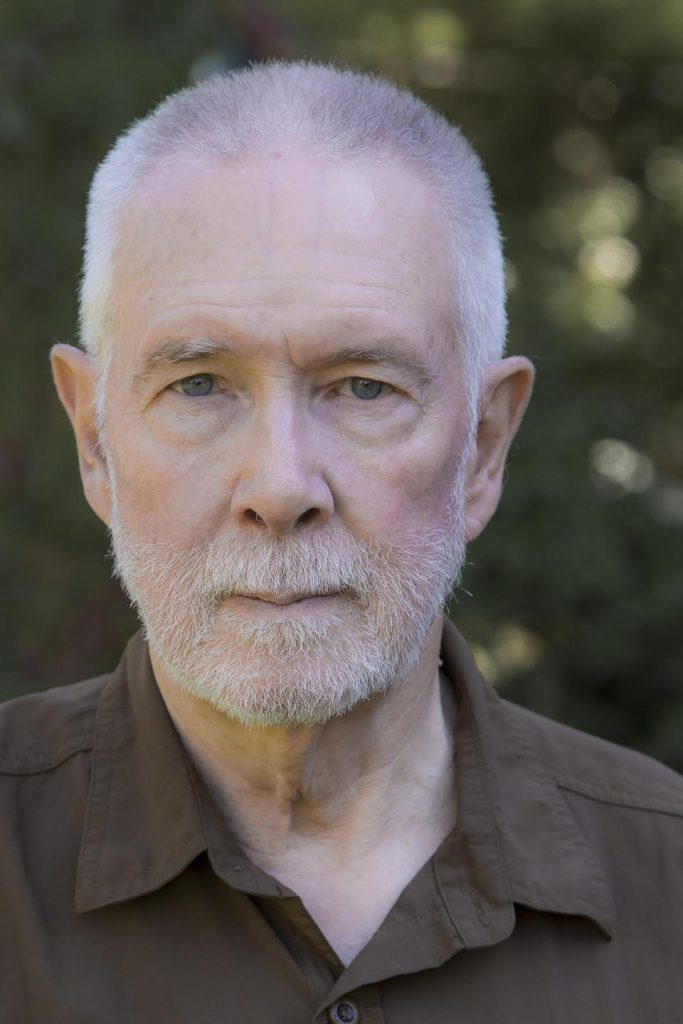

Philip Dowds is responding to a coho-l inquiry: is cohousing really a lot more expensive than a similar but bigger house in a somewhat equivalent middle or slightly upper-middle class neighborhood?

I always look at this one differently: Cohousing costs exactly the same as “regular” housing.

Turn the question around: How much housing can we afford? When we go shopping for housing, the main constraint is location, and after that, it’s size and quality. But we all have an approximate housing budget we see ourselves working with. If we stay within that budget, we will have money leftover for food, clothing, dentistry, savings, a car, and maybe a vacation. If we go way over that budget, we will be pinching pennies to pay for all other aspects of our lives.

What’s a typical or average housing budget? Lot’s of room for debate here, but estimates and recommendations are that a maximum of 25% to 30% of disposable income should go toward rent or mortgage, insurance, property taxes, and condo / HOA fees. This is an average or target for middle income families. The poor tend to pay a (much) higher percentage, which is why they have so little for other life expenses. Households in other circumstances may pay less, because the mortgage is paid off (it can happen, yes it can), or because they don’t want or need “big” or “fancy” houses.

Anyway, we all have personal and family budgets for housing. In the conventional single family market, that budget will buy us a certain location, size and quality of home. In the cohousing market, we pay the same (it’s what we can “afford”), but we get more commons, less privatized sq ft, and a *very* different lifestyle.

Cohousing is hardly an “elite” enterprise; I don’t have much sociology to back this up, but I am guessing that most “elites” are looking for privacy and “luxury”, not community. Nonetheless, cohousing strikes many shoppers as “expensive” because …

(1) The private residence portion feels “small” compared to a some single family units around the corner.

(2) There isn’t much to choose from (yet). And,

(3) Average housing cost in general is rising faster than average household income, particularly in “good” locations.

So there is no reason for cohousing to be cheaper than regular housing. Even so, I think there are several cost advantages cohousing offers, and/or could exploit better. These are …

(1) SHARED SPACE. If you have access to a communal arts and crafts room, you may not need a finished basement; if you have access to communal guest room, you may not need a private “spare” bedroom. If you have access to a common dining room, your own dining/living space may work just fine even if it’s very small. In cohousing, most of us just don’t need a “big” house. (Yes, I know, this runs contrary to the American dream …)

(2) MULTIFAMILY CONSTRUCTION FORMAT. At the same quality levels, dwelling units that share foundations, walls, roofs, and utility systems will always be cheaper per sq ft than single family homes. Duplexes have a slight advantage; row houses more so; and apartment buildings will do best of all. (If zoning allows them.)

(3) SHARING GENERALLY. Cohousing has sharing opportunities rarely present in other housing models. Buy and share a commercial-grade ISP / wifi. Buy and share a community car for errands around town. Share baby-sitting services. Share an electric knife sharpener, or some other amenity one would probably not buy on one’s own. These items may sound trivial; nonetheless, they do add up to a significant portion of many private budgets. (But they are hard to compute when one is deciding what to pay for a dwelling unit.)

At bottom, cohousing is neither more expensive nor less expensive than the alternatives. It’s just very different.

hanks,

Philip Dowds

Cornerstone Village Cohousing

Cambridge, MA

Category: Finance and Legal

Tags: Affordability, budget, Finance, living in cohousing, sharing

Views: 905